Analysis of China's import & export of building and sanitary ceramics in 2021

In 2021, under the background that the global epidemic situation remains severe, there are many obstacles to economic recovery, the international situation is complex and changeable, and the dividends of globalization are gradually disappearing, China has maintained a global leading position in economic development and epidemic prevention and control. The import and export of foreign trade achieved rapid growth in 2021, the scale reached a new high and the quality improved steadily, which made an important contribution to maintaining the stability of the global industrial chain and supply chain and helping the recovery of the world economy.

In 2021, Although China’s building ceramic sanitary ware industry affected by the macro-control of real estate and the policies of double carbon and double control, experienced multiple tests of raw material prices rising and energy costs, labor costs and shipping prices rising, but under the strong leadership of the Party Central Committee, the promotion of government departments all levels and the joint efforts of the whole industry, It still maintained the stable development of foreign trade and created a good start for the development of the industry during the 14th Five-Year Plan period.

In 2021, the cumulative export value of China’s building and sanitary ceramics products (excluding bathroom hardware products) was US $15.77 billion, a year-on-year increase of 11.43%. China’s foreign trade of building and sanitary ceramic products presents the following characteristics in 2021:

1. Under the background of repeated epidemics and complex and changeable external environment in 2021, China still remains the largest country in the export volume of building ceramics and sanitary ceramics, which provides a strong guarantee for maintaining the supply-demand balance of the global sanitary ceramics market;

2. Under the background of the continuous spread of overseas epidemic and the twists and turns of global economic recovery, China’s export volume of ceramic tiles decreased slightly in 2021, but remained stable as a whole, and the average export unit price continued to rise steadily;

3. Affected by the epidemic, overseas economic recovery was blocked, production could not be carried out normally, production capacity could not be fully released, and it was difficult to continuously meet the rigid market demand. Overseas orders were continuously sent to China. China's sanitary ceramics exports expanded in line with the trend, with double-digit growth in export volume and export amount at the same time, and the growth curve continued to rise;

4. Nearly 80% of the ceramic tiles export to the developing countries, especially the countries along the One Belt One Road. More than 50% of the sanitary ware export to the developed countries and regions, The overall share pattern of export flows to regions has not changed significantly.

5. The export volume of ceramic color glaze products in 2021 increased significantly compared with that in 2020, and the export scale was further expanded. However, on the premise that the overall unit price was basically the same as last year, considering the adverse factors such as the increase of raw material price and the increase of labor transportation cost, the profit margin of ceramic color glaze products shrank.

Export analysis of building ceramics

(1) General situation of export

In 2021, the export volume of building ceramics was 601 million square meters, a decrease of 3.40% than 2020, and the export amount was US $4.099 billion, a year-on-year decrease of 0.70%. China's export volume of building ceramics has been on a downward trend since 2015. In 2020, affected by the global epidemic and Sino US trade friction, the decline was particularly obvious. In 2021, the decline rate of export volume slowed down and the decline curve tended to be flat. On the one hand, this is because the impact of the epidemic has subsided. On the other hand, it has also benefited from a series of incentive measures launched by governments and international organizations to revitalize the economy.

Thanks to the rise in the unit price of exported building ceramics, it increased by 2.80% from US $6.63/m2 in 2020 to US $6.82/m2. The export amount in 2021 fell only 0.70% compared with that in 2020. On the one hand, the increase in the price is due to the impact of the rising costs of energy, raw materials, labor and environmental protection investment, on the other hand, it also reflects the trend that China's ceramic tile products gradually withdraw from the low-end product market and gradually transform to medium and high-end products.

At the same time, China's export volume and export amount of building ceramics remain the first in the world, which plays an important role in ensuring the supply and price stability of the global market.

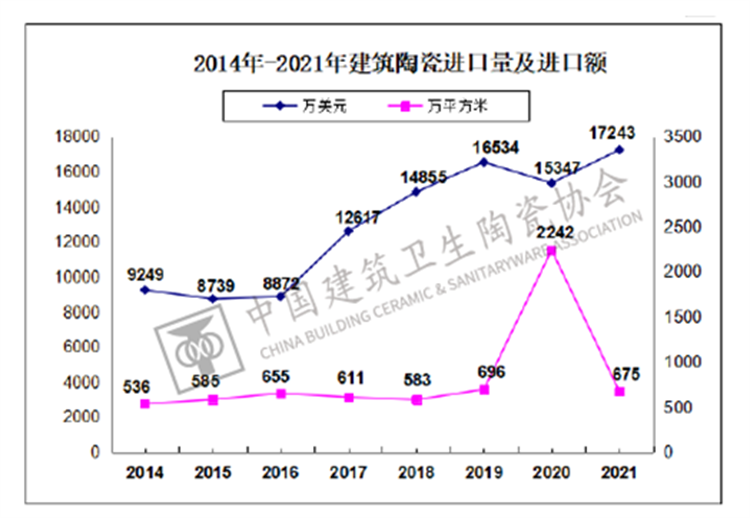

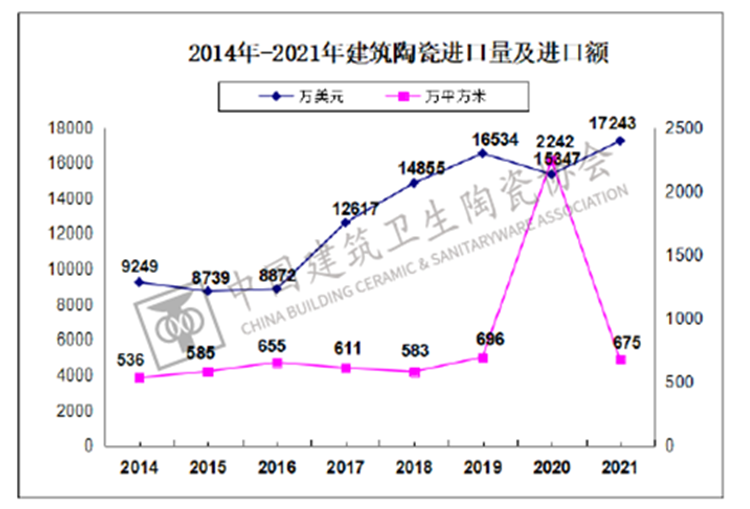

(2) General situation of import

In 2021, China's import volume of building ceramics was 6.75 million square meters, a decrease of 69.90% over 2020. The import amount was about 155 million US dollars, a year-on-year increase of 12.35%. The import unit price was 25.56 US dollars / square meter, with a growth rate of 273.26%.

The sharp fluctuations in the import curve from 2019 to 2021 can be seen more clearly from the figure below. The import volume soared in 2020, but the import amount did not rise but fell. After tracking and investigating the abnormal data, the association found that a transaction with high value but low unit price occurred in 2020, which forcibly deviated the import curve from the conventional development track. Therefore, the change of import volume and import amount in 2021 is actually the regression of the curve to the normal level.

Compared with 2019 in the pre epidemic era, the import volume of building ceramics in 2021 decreased by 3.01%, the import amount increased by 4.28%, and the import unit price continued to rise.

(3) Top ten destination countries for ceramic tile export

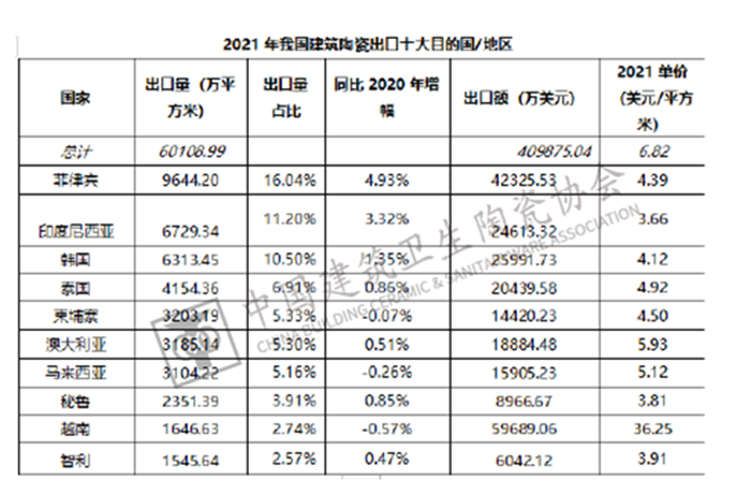

Under the category of building ceramics, the export volume and export amount of ceramic tiles account for 98.94% and 97.61% respectively. The following export flow direction and origin analysis will focus on ceramic tiles.

In 2021, China's export volume of ceramic tiles was 595 million square meters, and the total export volume to the top ten major countries or regions was 419 million square meters, accounting for 70.42% of the total export volume, an increase of 11 percentage points compared with 59.27% in 2020, indicating that China's export concentration of ceramic tiles has further improved.

In 2021, eight of the top ten countries exporting ceramic tiles were RCEP members, except Peru and Chile, which ranked eighth and tenth. Compared with the ranking in 2020, the Philippines continues to rank first, with its export volume increasing by 4.93% year-on-year in 2020. Indonesia and South Korea exchanged places in 2020. Myanmar, which ranked ninth in 2020, fell out of the top 10 in 2021, and Chile, which ranked 12th in China's ceramic tiles imports in 2020, entered the top 10 list and ranked 10th.

In addition, according to the statistics of export amount, Vietnam is the first target country for China's export of ceramic tiles, with an export amount of about 597 million US dollars, mainly because the average unit price of ceramic tiles exported to Vietnam is 36.25 US dollars / square meter, several times that of products exported to other countries.

(4) Origin of export ceramic tiles

In 2021, Guangdong Province topped the list with the export volume of 366 million square meters of ceramic tiles and the export amount of 1.749 billion US dollars, accounting for 60.89%, basically the same as last year's 60.91%. Because the unit price of ceramic tiles exported from Guangdong Province is about 50% lower than the average national export unit price, the proportion of export amount of Guangdong ceramic tiles is lower than the export volume, accounting for 42.68%. This figure is nearly two percentage points higher than that in 2020, but it is still far from the proportion of about 60% in the pre epidemic era.

Fujian Province, which ranks second in the export volume, accounts for 23.74% of the national total, and the export amount accounts for 15.40% of the total. The average export unit price is US $4.42/m2, which is also lower than the national average export unit price.

Guangdong and Fujian also occupy the top two export provinces for a long time, and have maintained a double-digit proportion. Shandong's export volume ranks third, accounting for 4.58% of the total, and the export amount accounts for 7.98% of the total. But its average export unit price is much higher than the industry average level, ranking first in the country.

Export analysis of sanitary ceramics

(1) General situation of export

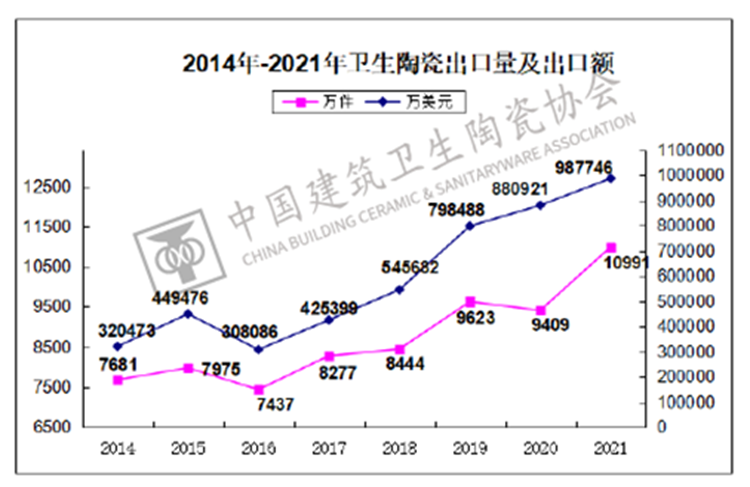

In 2021, China's export volume of sanitary ceramics was 110 million pieces, an increase of 16.82% over 2020. The export amount reached US $9.878 billion, an increase of 12.13%, with an average of US $89.87 per piece, a decrease of 4.02% over the previous year. In addition to the slight decline in the export volume in 2020 due to the impact of the epidemic, the export volume of sanitary ceramics has maintained growth since 2016. Also, due to the low base in 2020, superimposed on the growth of worldwide demand for sanitary ceramics and the impact of insufficient overseas production capacity, the growth rate increased and the growth curve became steeper in 2021.

The export of sanitary ceramics can maintain steady growth from 2016 to 2021, On the one hand, the export of sanitary ceramics is not affected by the international trade situation. More importantly, China's sanitary products have absolute competitiveness in the world with the advantages of high quality and beautiful price. In 2021, the export proportion of sanitary products in China remained around 40%.

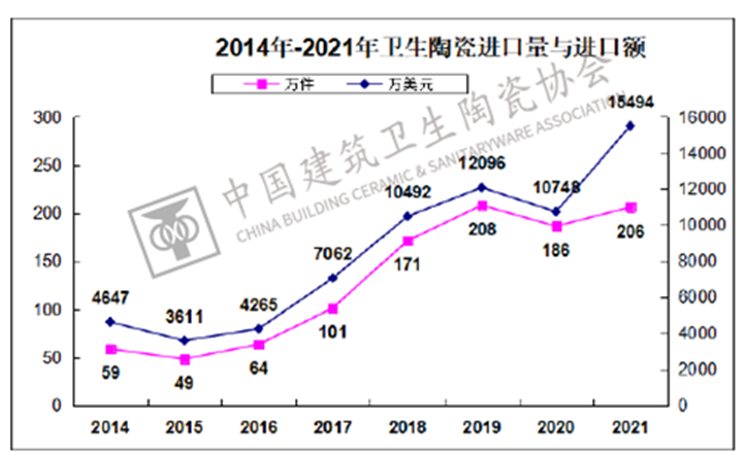

(2) General situation of import

After experiencing the decline caused by the epidemic in 2020, the import volume of sanitary ceramics in 2021 rebounded to 2.06 million pieces, which was basically the same as that in 2019. Affected by the 30.33% increase in import unit price, the import amount of sanitary ceramics reached US $155 million, an increase of 44.14% over 2020.

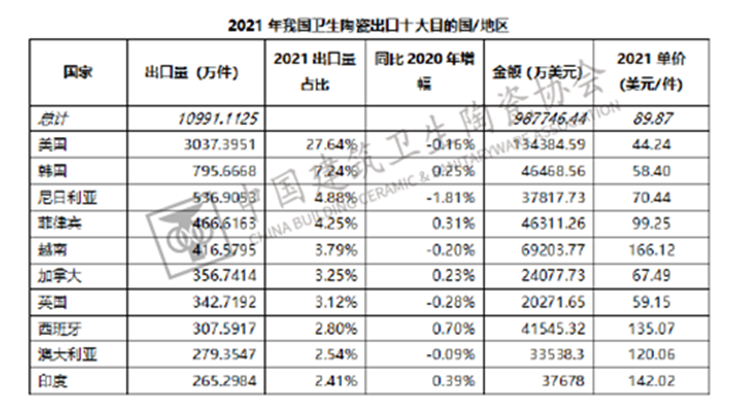

(3) Top ten destination countries for sanitary ceramics export

In 2021, China's sanitary ceramics exports to Europe, America and other developed countries and regions accounted for nearly half of the total exports, which was basically the same as that in 2020, indicating that China's sanitary ceramics products still maintain strong competitiveness in developed regions.

In 2021, the exports of the top ten major countries or regions accounted for 61.91% of the total exports of sanitary ceramics. Among them, the exports of the top five countries or regions accounted for 47.79% of the total. The difference between the two data and 2020 was less than 1%. But several major export target countries changed greatly. Saudi Arabia, Singapore and Malaysia ranked among the top five in 2020, falling out of the top ten, Canada, Britain Australia returned to the top 10 after experiencing a decline in its share in 2020.

(4) Origin of exported sanitary ceramics

The top five sanitary ceramics proportion of export volume and export amount of major provinces and cities in China are basically the same as in previous years. Guangdong Province still occupies the first place. The ranking of Hebei, Fujian and Shandong has not changed compared with that in 2020, and the subsequent ranking of Jiangsu and Zhejiang is just the opposite from that in 2020. The proportion of Tianjin and Henan rose to the top eight.

Among the top eight production areas in terms of export volume, the unit price of sanitary ceramics products in Jiangsu and Shandong is the highest, both exceeding US $100 / piece.

Export analysis of color glaze

(1) General situation of import and export

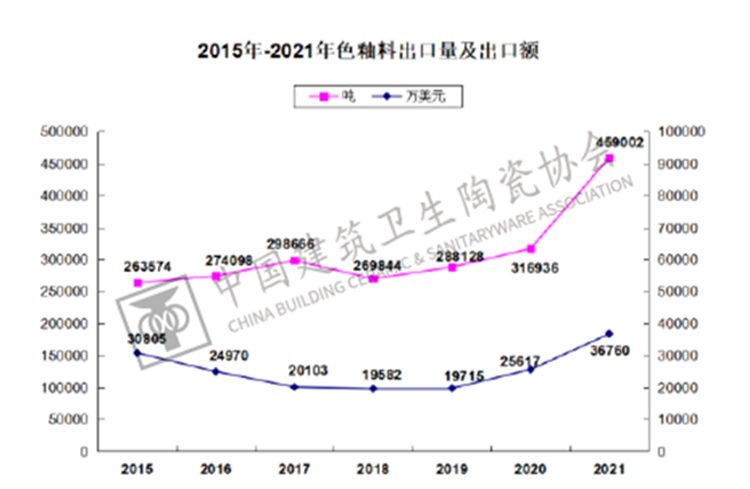

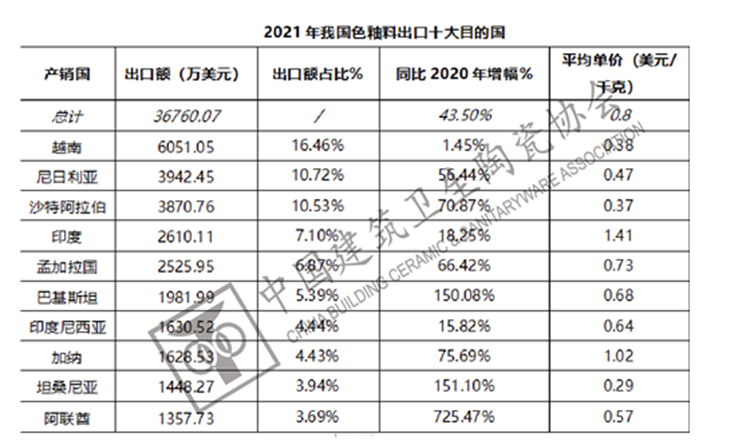

In 2021, the export volume of ceramic color glaze products was 459000 tons, a significant increase over 2020, with a growth rate of 44.82%. The export volume was 368 million US dollars, with a year-on-year increase of 43.50%. The export scale was further expanded.

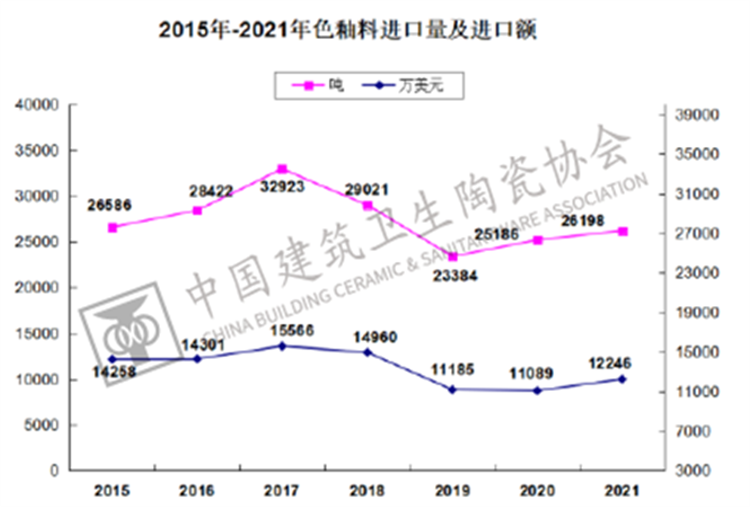

The import volume of ceramic color glaze products was 26200 tons, with an import amount of 122 million US dollars, basically the same as that in 2020.

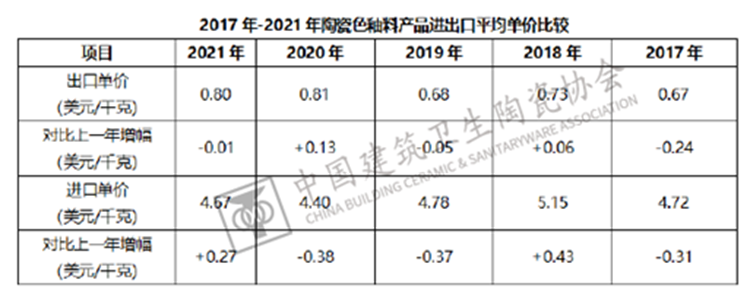

Comparing the export unit price, it can be seen that the overall unit price of color glaze products in 2021 is basically the same as that of last year without obvious fluctuation. Considering the adverse factors such as the increase of raw material price and the increase of labor transportation cost, the export profit margin of color glaze industry shrinks.

(2) Top ten destination countries for color glaze export

The ceramic color glaze products exported to Asian countries or regions accounted for about 68.02% of the export volume, slightly lower than that in 2020 (71.20%). The top ten major export flows to countries or regions accounted for 73.58% of the export volume, which was basically the same as that in 2020 (74.67%).

(3) Origin of export color glaze

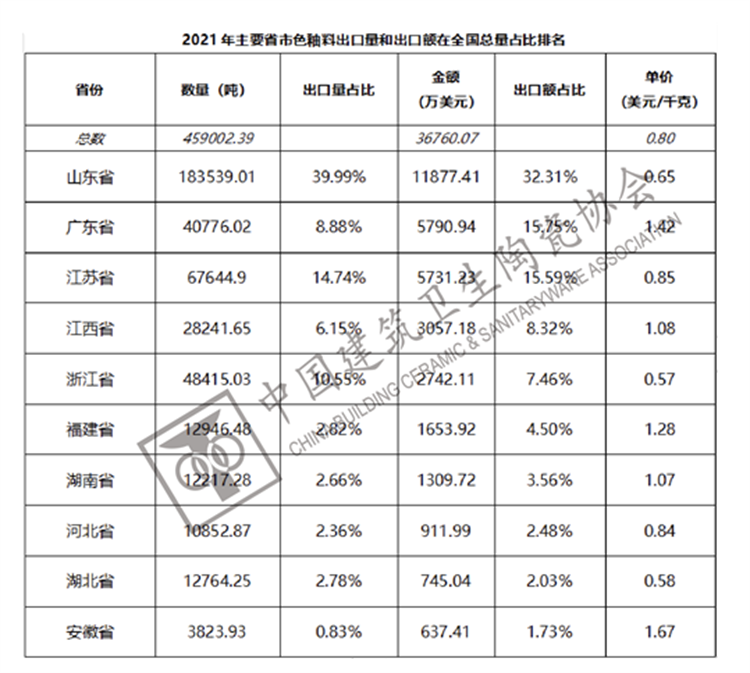

The total export amount of Shandong, Guangdong, Jiangsu, Jiangxi and Zhejiang provinces accounts for nearly 80% of the total export amount of the country. Among them, Shandong topped the list with the export volume of 18,3500 tons of color glaze and the export amount of US $119 million, accounting for 39.99%, dropped down nearly 5 percentage points from 44.85% last year.

Post time: Mar-10-2022